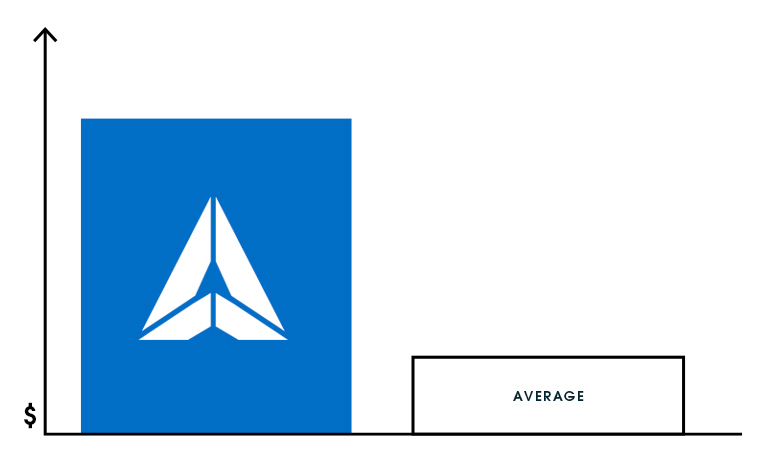

Are you ready to earn more dividends as you save?

We’re here to lead the way to smart savings and big rewards. Our free savings calculator can help you achieve your financial goals.

Enter your starting amount, estimated monthly savings, and interest rate to calculate how much you can save. You can use this information to fine-tune your long-term financial goals. You can even email your results to yourself, so they’ll always be accessible.